Market Data

Market for beauty and cleanliness is growing significantly

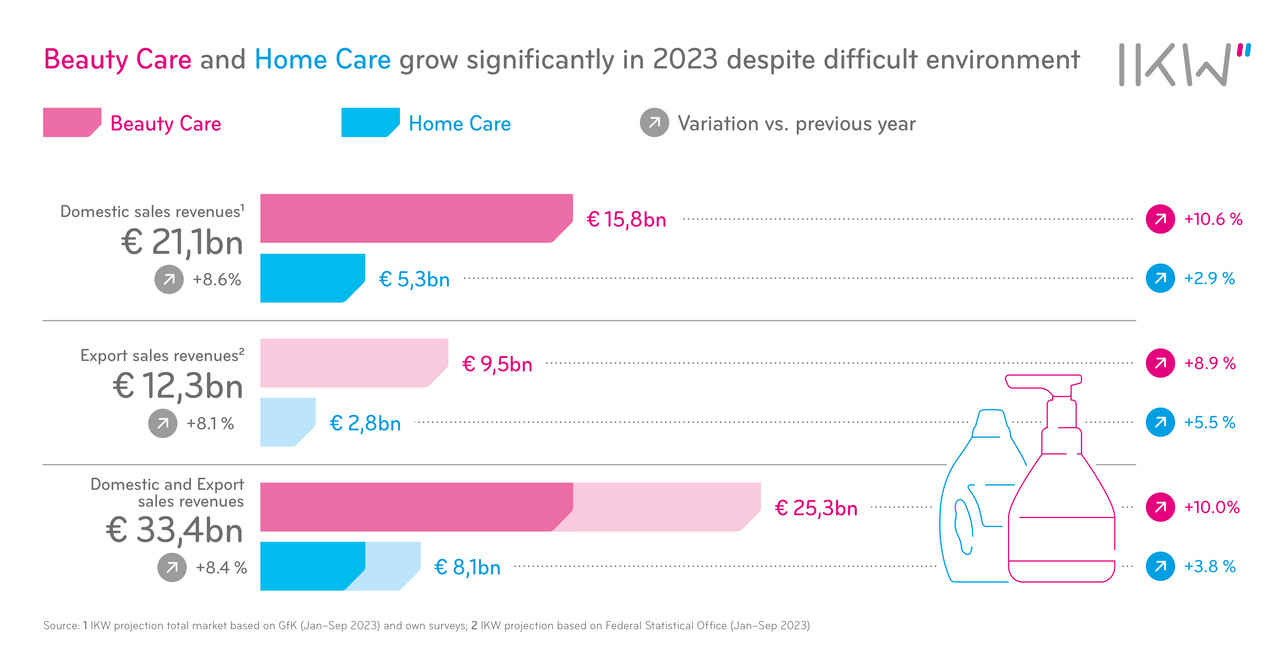

- Sales revenues with beauty and home care products rise to EUR 33.4 billion

- Fragrances, make-up and detergents remain growth drivers

- Industry fulfils consumer wishes in a difficult environment - Pressure on companies as a result of cost increases, bureaucracy and a shortage of skilled labour

Frankfurt am Main, 7 December 2023. Consumers spent more than ever before on an attractive appearance, well-groomed clothes and a clean home in 2023. Based on projections for the full year, the companies organised within the German Cosmetic, Toiletry, Perfumery and Detergent Association (IKW) report an increase in sales revenues of 8.4 percent to EUR 33.4 billion. Domestic sales revenues rose by 8.6 percent to EUR 21.1 billion. Export sales grew by 8.1 percent to EUR 12.3 billion. Companies are concerned about persistently high costs for energy and raw materials and the planning uncertainty associated with the escalating global political situation. A shortage of skilled labour and growing bureaucracy are putting additional pressure on the predominantly medium-sized industry.

Cosmetics in demand

A persistently bleak consumer climate, a pronounced propensity to save and general concerns about the future - the beauty and home care industry has largely been able to move away from this difficult economic environment this year. Its products remain consumer favourites. Domestic sales revenues from body care and cosmetics rose by 10.6 percent to EUR 15.8 billion. Deodorants showed the highest growth (up 21.2 percent), followed by decorative cosmetics, i.e. lipstick, make-up, nail polish & co (up 17.7 percent). Fragrances follow with a 15.0 percent increase in sales. People want to emphasise their personal appeal and feel good in their own skin. This is reflected by the increased sales revenues of hair care products (up 9.9 percent), bath and shower additives (up 9.2 percent) and skin and facial care (up 8.6 percent). Soaps and syndets, which were in high demand during the pandemic years, were the only category of beauty care products to record negative growth (down 8.9 percent).

IKW Director General Thomas Keiser comments: "Cosmetics are the little luxuries of everyday life – especially in difficult times. And we can't do without cosmetics. The IKW study of 2022 proves this."

A clean affair: detergents are on the rise too

The trend towards a positive appearance corresponds to the consumer desire to wear clean and well-groomed clothes. The leading products in the home care segment are light-duty and special laundry detergents (up 8.1 percent). People also spent significantly more on laundry detergent aids (up 7.6 percent) and fabric conditioners (up 5.1 percent). The increase for dishwashing products was 3.3 percent, and 1.5 percent for home cleaning and care products. Overall, the German retail sector achieved a 2.9 percent rise in the sales value of home care products to EUR 5.3 billion. A clean and pleasant home is important to people in Germany, as a recent study by IKW shows: 78 percent of those surveyed have a good feeling of having achieved something after cleaning. 70 percent consciously enjoy the cleanliness after cleaning.

Drugstores remain popular

Germans prefer to buy their cosmetics and detergents, care and cleaning products in drugstores. The picture from previous years is once again confirmed in 2023, with this sales channel accounting for 51 percent of beauty care products, followed by specialist retailers in second place with 20 percent. Home care products are also predominantly purchased in drugstores with a share of 34 percent, but discounters are equally important for this business, accounting for 26 percent. E-commerce is growing strongly in both sectors (plus 23.8 percent for beauty care and plus 29.2 percent for home care). However, their share in the overall market is still comparatively low at 7 and 4 percent, respectively.

Society in a permanent crisis mode - economy under pressure

With violence and war in Europe and the Middle East and the resulting further intensification of the global political crisis, the tense situation for companies has likewise continued. In a recent survey of IKW member companies, 62 percent stated that they were severely or very severely affected by the cost increases for energy and raw materials. In addition, there are more stringent requirements due to regulations. The President of IKW, Georg Held, says: "Our companies are strongly and wholeheartedly committed to sustainability. However, the European Green Deal alone is expected to result in several thousand pages of regulations. We would like to see practical common sense prevail in planning and implementation, in the interests of a healthy economy and hence also a successful sustainability transformation."

Uncertain outlook

Against the backdrop of international trouble spots and a possible further escalation, the outlook for 2024 is characterised by uncertainty. Georg Held: "Our industry has shown strength in the past few difficult years. Proximity to consumers, innovative strength and the attractiveness of our products and services provide a good foundation on which we can continue to grow." Thomas Keiser adds: "We remain cautiously optimistic and expect sales revenues to grow by 2.5 percent in the coming year."

The press release, you can find here, the market data sheet here and the graphic here.

Sources:

Domestic sales: IKW projection based on GfK (Jan - Sept 2023) and own surveys

Export sales: IKW projection based on the Federal Statistical Office (Jan - Sep 2023)

Studies: Cosmetics as Essential Everyday Companions – the Psychological and Physical Relevance of Cosmetic Products for People (ikw.org)

How Germany Cleans: Housework between Social Norms and Sustainability (ikw.org)

About IKW

The German Cosmetic, Toiletry, Perfumery and Detergent Association, with headquarters in Frankfurt am Main, was founded in 1968. It represents the interests of more than 440 companies from the fields of beauty and home care on a national and European level. The industry generates sales revenues of more than EUR 21 billion and employs a workforce of approximately 50,000 people. The member companies cover approximately 95 % of the market.

IKW is the contact partner for its member companies, ministries, public authorities, consumers, institutions and associations as well as for the media as far as scientific, regulatory or business topics are concerned. Experts of the competence partners Beauty Care and Home Care within IKW provide competent answers on questions concerning skin and hair care, beauty and self-esteem as well as hygiene and cleaning. More information on www.ikw.org

Contact

Karen Kumposcht

Public Relations/Public Affairs Manager

Industrieverband Körperpflege- und Waschmittel e. V.

The German Cosmetic, Toiletry, Perfumery and Detergent Association

Mainzer Landstrasse 55, 60329 Frankfurt am Main, Germany

T +49.69.2556-1331 / F +49.69.237631

kkumposcht@ikw.org / www.ikw.org